Document service companies that print bills and invoices can benefit by educating their clients on the value of accepting electronic payments. Processing electronic payments differ from sending out postal mail invoices and remittance envelopes and requires some specialized software available from Racami.

Signing up for payment services from a print/mail provider can allow billers to add this functionality without investing in a payment platform themselves. Companies that have not been involved with electronic payments may have inquiries about how they work. Here are some points that can answer their questions:

1. What is Electronic Bill Presentment and Payment?

EBPP delivers bills through the internet. Billers collect payments electronically through the internet, direct-dial, and other methods. EBPP is a core component of online banking for most financial institutions. Industries using EBPP extensively include insurance, telecommunications, and utilities.

EBPP consists of two functions: presentment (delivery of the bill or invoice) and payment (transfer of funds from customers to billers). However, companies that bill their customers only on paper can still take advantage of electronic payments. The bill doesn’t have to be electronic to enable the payments to be so.

2. Electronic Payment Methods

Regardless of how a bill is delivered, whether on paper or electronically, a biller may offer an electronic payment method to the customer. In most electronic payment systems, billers have many ways to collect payments. Options include credit and debit cards online, e-checks, ACH, and mobile.

Many solutions offer one-time and recurring payments, invoicing, and online payment forms linked to the client’s website. Every company needs to get paid as quickly as possible and offering choices consistent with the recipient’s comfort zone encourages customers to pay sooner.

3. Credit Card Processing and ACH Processing

Electronic payments can be divided between credit card and ACH (Automated Clearing House) transactions. Credit card payments are simply charged to the customer’s credit card account. An ACH payment is an electronic bank-to-bank payment. ACH transfers money between bank accounts, rather than going through card networks or using wire transfers, paper checks, or cash. Most payment systems offer the ability to process both, making it easy for customers to pay a bill.

4. Electronic Payment Funding Time

Funding time is the time needed to process a payment. Time is critical for companies considering electronic payments as it is a vital part of cash flow. Standard funding time can vary between two to five days, depending on the payment type (ACH or credit card), the processor, and the solution provider.

Payment by credit card has a higher transaction fee but funds faster. Payment by ACH takes longer, but the transaction fees are often lower.

5. Electronic Payment Authorization

Billers and customers reference transaction authorizations during a review of specific payments, like an audit or a dispute. An authorization document defines the rules for payments and gives the payment processor permission to charge a customer’s credit card account or withdraw funds from customer bank accounts.

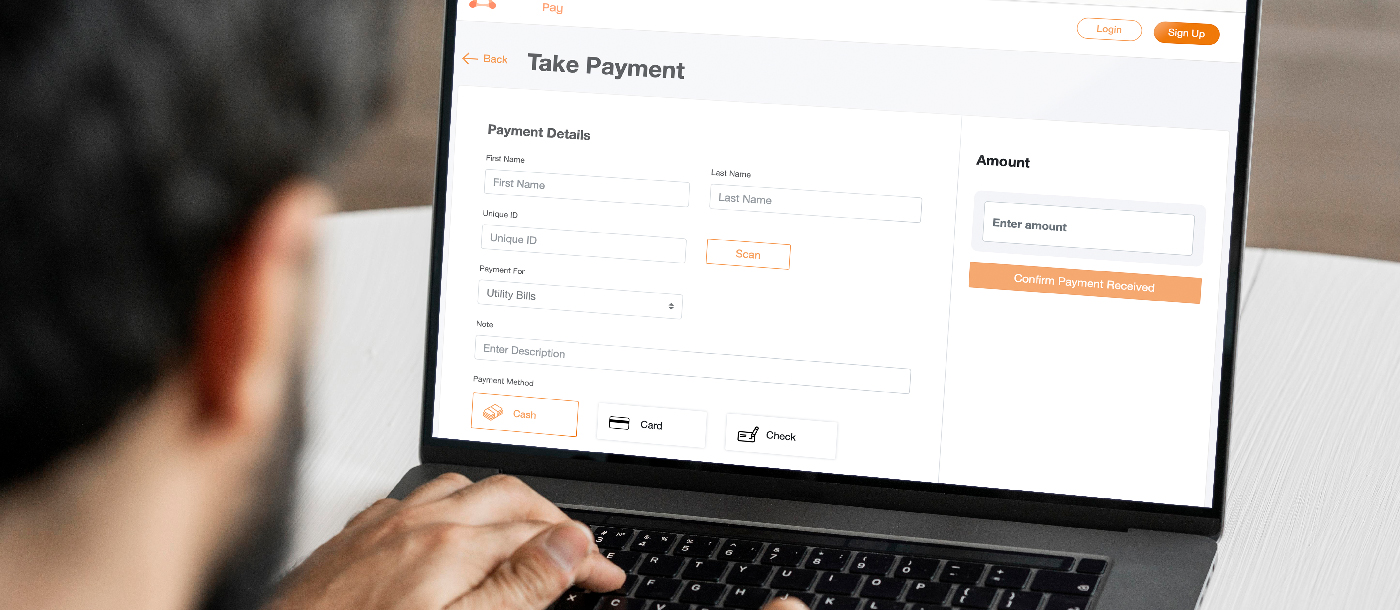

6. QR Code Electronic Payments

QR codes are barcode images that contain information for both the merchant and payment provider. This type of payment functions like a standard retail point-of-sale terminal. A customer uses their phone to scan the QR code and completes the payment instantly. Once a smartphone camera detects the QR code, a push notification takes the customer to a screen where they add their payment details to complete a purchase or make a payment.

7. Marketing Electronic Payment Services

It is not enough for a biller to decide one day they will offer an electronic payment service. Like any product or service, billers must market the option of electronic payment. Some customers like paper invoices and paying online. They may not be fond of electronic delivery. Billers must communicate information about the electronic presentment and payment options with paper mail besides email. This ensures that everyone will be reached with information about the new payment service.

Remind customers that choosing the way they like to pay is entirely up to them. Electronic payment offers time and cost savings and is wholly convenient, but cashing a check still works. The key is marketing the new service without scaring anyone off.

Implementation

Adding electronic bill presentment and payment processing to your workflow software dashboard is simple. If the application you use does not have the option for EBPP, visit https://racami.com to learn about Alchem-e™. Alchem-e is a comprehensive print-mail workflow application that manages labor, equipment, throughput, and more from a single dashboard. Administrating EBPP is just another step in each customer’s workflow.

The Alchem-e™ Pay option adds more billable services to a print/mail service provider by driving paperless invoicing and payment. You print and mail a client’s bills but your clients may be looking for more functionality. Offer them electronic bill presentation and payments as well and brand an Alchem-e™ Pay website for your print-mail service bureau. Alchem-e™ Pay is an intuitive platform that customers will use. Your clients will increase customer satisfaction, boost revenue, and optimize the customer experience while you strengthen the relationship with your clients and add billable services.